SaaS SEO Guide

Leaders & Losers in VoIP and Telecommunications SEO

Book a FREE SEO Strategy Consultation >

Further Reading:

- SaaS SEO Strategy

- SaaS SEO Checklist

- SaaS Technical SEO

- SaaS SEO Audit

- SaaS Keyword Research

- SaaS SEO Content

- SaaS SEO Copywriting

- E-A-T for SaaS

- Enterprise SaaS SEO

- SaaS SEO Metrics and KPI's

- SaaS SEO Attribution

- VOIP and Telecommunications SEO Strategy

- SaaS Link Building

- Payroll and Finance SaaS SEO

- SaaS SEO Agency

- SaaS Link Building Agency

In any business, it’s wise to know your main competitors and what they’re doing right. For companies in the communications SaaS niche, where search engine rankings are key to visibility and revenue, it’s essential to understand who’s getting traffic for relevant keywords and why.

Visualizing your rivals on a Share of Value graph is a great place to start. But what exactly does Share of Value mean, and how can it help you improve your own SERP rankings? Let’s find out.

Introduction to telecoms SaaS

Telecoms SaaS describes any communications software available as a service.

Just as in any SaaS sector, the vendor owns and maintains the software while the user pays monthly or annually for a subscription—instead of installing costly tech on their premises. VoIP phone systems and contact center platforms are common examples of communications SaaS.

Current state of the market

There are hundreds of telecoms and VoIP businesses that have competitive footprints within SaaS. To stay competitive, many of them have optimized their products to appeal to particular teams. For example, Convoso and ConnectAndSell have positioned their products for sales teams.

Also sitting in this space are VoIP providers that offer a huge range of services and products to cater for enterprise businesses. These include companies like RingCentral, Dialpad, Vonage, and Nextiva. They’re some of the key players in the market by revenue.

The COVID pandemic was a major driver of growth in the telecoms SaaS market. When businesses scrambled to go remote, the industry expanded enormously.

Although growth has now slowed, it hasn’t stopped, as many businesses realized the benefits of remote and hybrid working and decided to make it permanent.

The global mobile VoIP market size was valued at USD 27.5 billion in 2015 and is expected to reach USD 145.8 billion by 2024. That’s a compound annual growth rate of 20.4%.

Looking ahead

The expansion of 5G networks is also good news for communications, and especially VoIP. Since it’s designed to provide an improved mobile broadband connection, it enables faster communication speeds and reduces latency issues. 5G is going to make VoIP a lot more viable for many businesses.

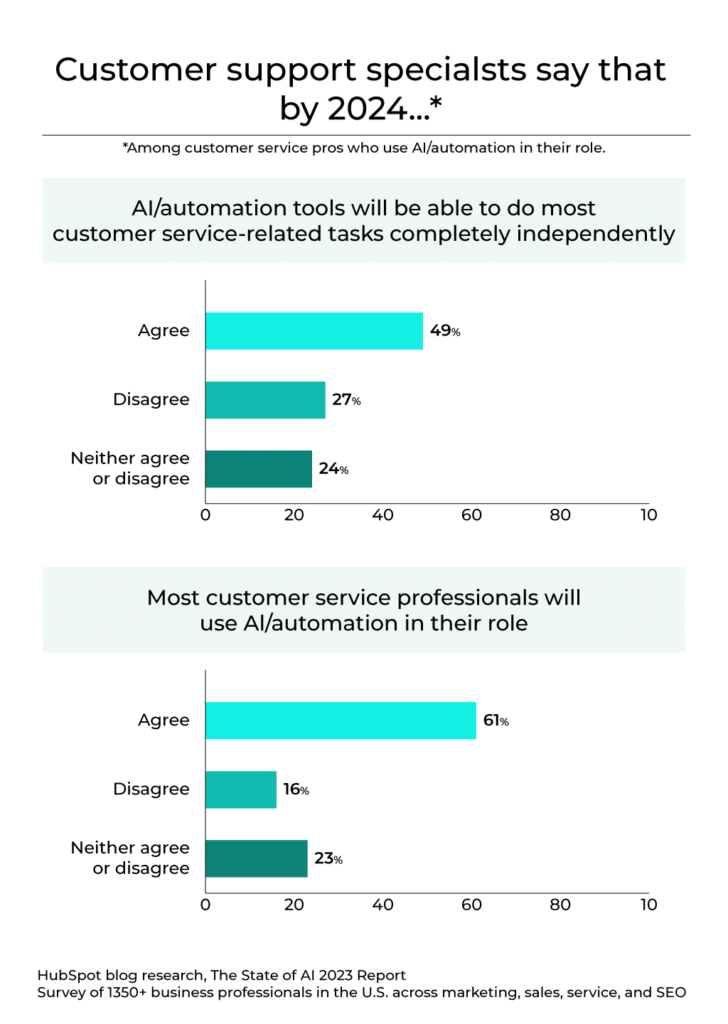

Meanwhile, ever-evolving AI has plenty of applications for business communications. As well as chatbots, virtual assistants and self-help options can handle simple customer queries, but AI can also help you understand sentiment and predict behavior.

Eventually, it’s expected that AI will overtake humans in customer service roles.

WebRTC is another technology that has only enhanced VoIP and will continue to do so. By providing real-time communication via APIs, it enables instant calls and live video support inside web pages and apps, without the need to install plugins or download tools.

The largest potential challenge for telecoms SaaS companies comes in the shape of security issues

Any internet-enabled tech can be vulnerable to threats and cyberattacks. VoIP’s rapid growth, too, has created some concerns, with hackers using unsecure VoIP systems to enter frameworks and spread malware.

Do you know your competitors?

As a SaaS business in the competitive VoIP industry, you may think you already know who your biggest rivals are. However, you might be surprised to find that they’re not always the ones you thought—and that brands you haven’t paid much attention to are actually hot competition.

At accelerate agency, we use a Share of Value graph to determine your top competitors. It looks at things from a much broader perspective, and allows you to see exactly who is dominating in the niche.

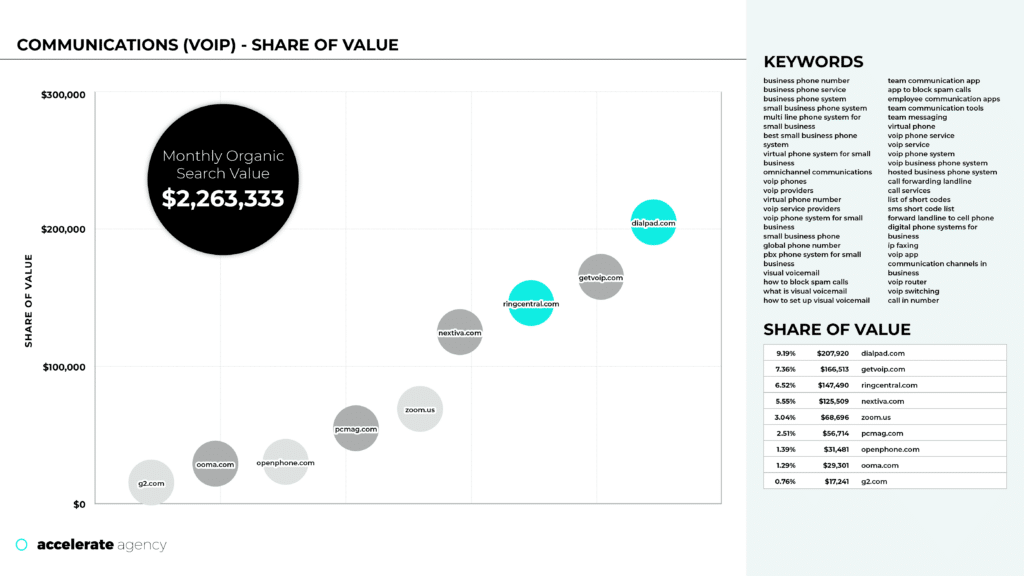

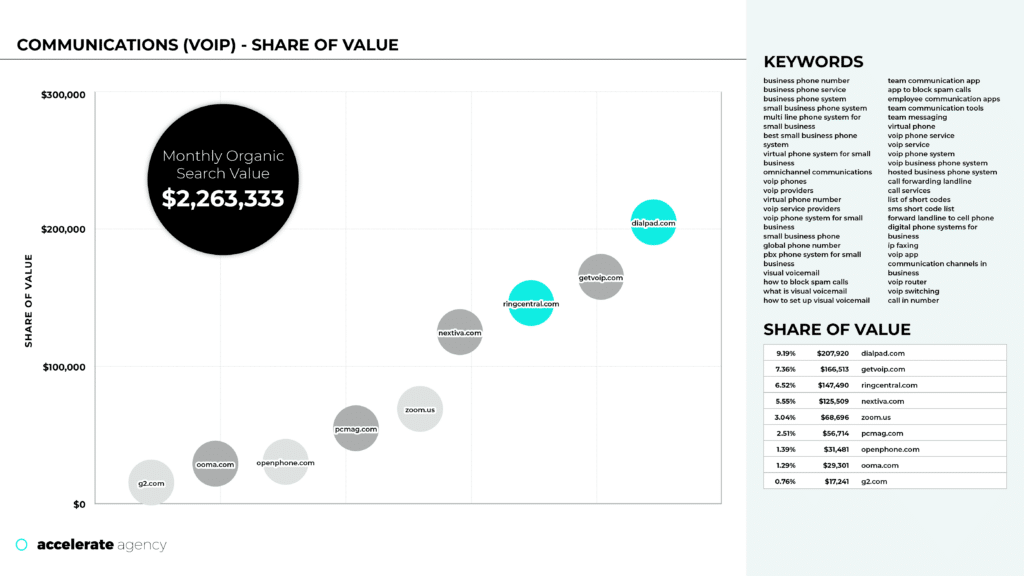

Share of Value

Share of Value graphs provide a snapshot of the proportional monthly value of a set of keywords that a domain is ranking for. We call this its traffic value, and when you visualize it against top competitors for this keyword, it can highlight the size of the opportunity in front of your domain.

To measure the traffic value of a keyword, we use the simple formulae:

Total monthly traffic x Estimated average CPC = Monthly traffic value

For example, if the keyword “VoIP Phone Service” had 6500 monthly clicks and a cost per click of $15:

6500 x $15 = traffic value of $97,500.

We then divide this total traffic value amongst the domains in the SERP that are ranking for this keyword. The higher the domains rank, the greater their share of traffic value.

Share of Value does more than just measure a domain’s position across a number of keywords. It also ties those positions to actual ROI, which is the amount you would have otherwise had to spend on PPC.

VoIP SaaS Share of Value

For our purposes, we’re looking at the Share of Value for VoIP SaaS companies. The specific sector SoV bubble contains all the major companies in this niche.

To produce this SoV graph, we looked at a wide range of keywords relating to VoIP, such as “business phone number”, “VoIP phone system”, and “team communication tools”. The combined monthly organic search value for the top nine competitors was $2,263,333.

You can see the companies plotted on the graph by their revenue, with their individual shares shown on the right.

However, we then need to drill down into the specifics, and find out why they’re doing well from an SEO point of view. That’s where Single Page Analysis comes in, and we’ll look at that shortly.

Who is currently doing well?

The leaders in the VoIP sector are RingCentral, GetVOIP, Dialpad, and Nextiva.

According to our SoV graph, Dialpad comes out on top, capturing 9.19% of the search value. The monthly organic value of the keywords they’ve captured is $207,920.

So, why are these companies currently doing well? It’s partly because their leaders understand the importance of the relationship between momentum and maintenance. For example, Dialpad and RingCentral put a significant emphasis on supporting all the content they build with authoritative backlinks, which are regularly maintained.

These types of businesses also know that it’s vital for various SEO stakeholders to work together. Their Web Teams, Content Teams, and wider Marketing Teams all understand the value of SEO and are synced on a specific strategy.

More generally, these businesses recognize that long-term success takes time—those at the very top started their SEO journey years ago.

Single Page Analysis

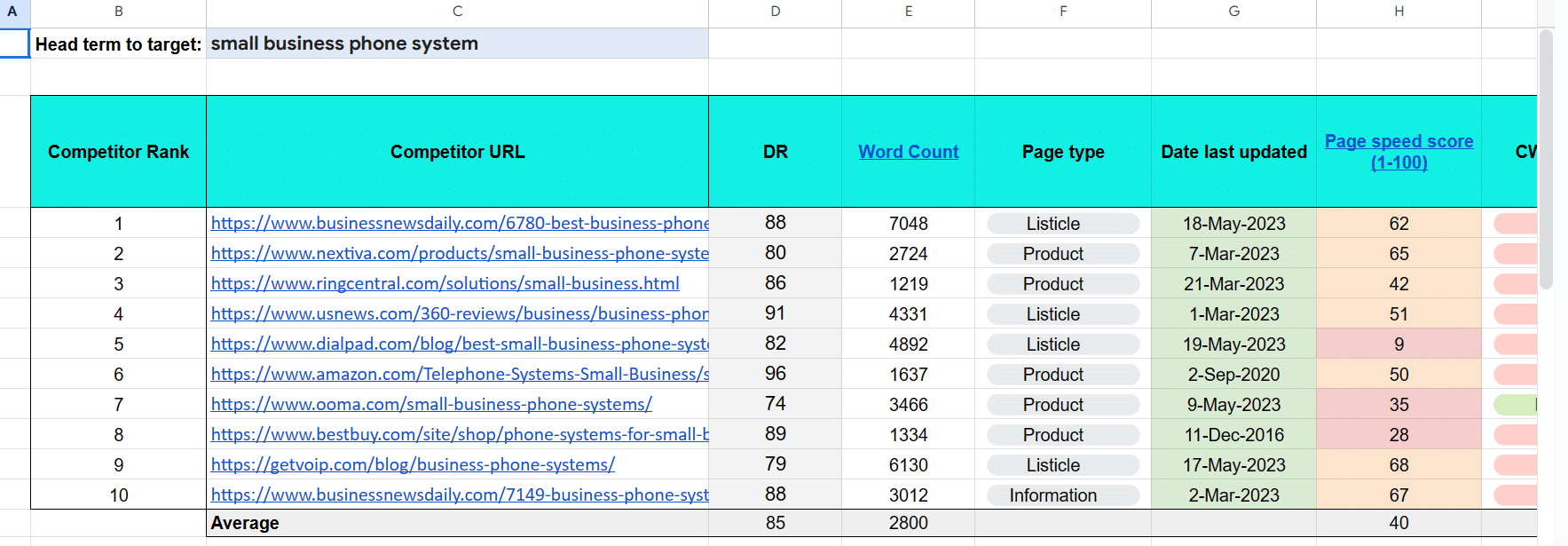

As we mentioned earlier, Single Page Analysis (SPA) helps you discover the reasons behind your main competitors’ success in the SoV bubble.

An SPA is a visualization of how the target page’s SEO ranking factors compare to those of competitors within the top 10 SERP positions.

It involves looking at a specific keyword on a more granular level. This allows SEOs to assess and understand two points:

- The factors influencing ranking potential

- The resources needed to make the target page rank competitively (and therefore, if there’s ROI in boosting that keyword’s ranking).

Our team looks at a number of considerations related to content, links, and technical SEO. For example, we don’t just look at the number of links or do-follow links above a certain threshold—we consider link-building velocity.

Single Page Analysis is like an X-ray of the SERP, but it also helps teams to measure efficient ROI gains within target keyword lists.

Single Page Analysis of “small business phone system” (VoIP)

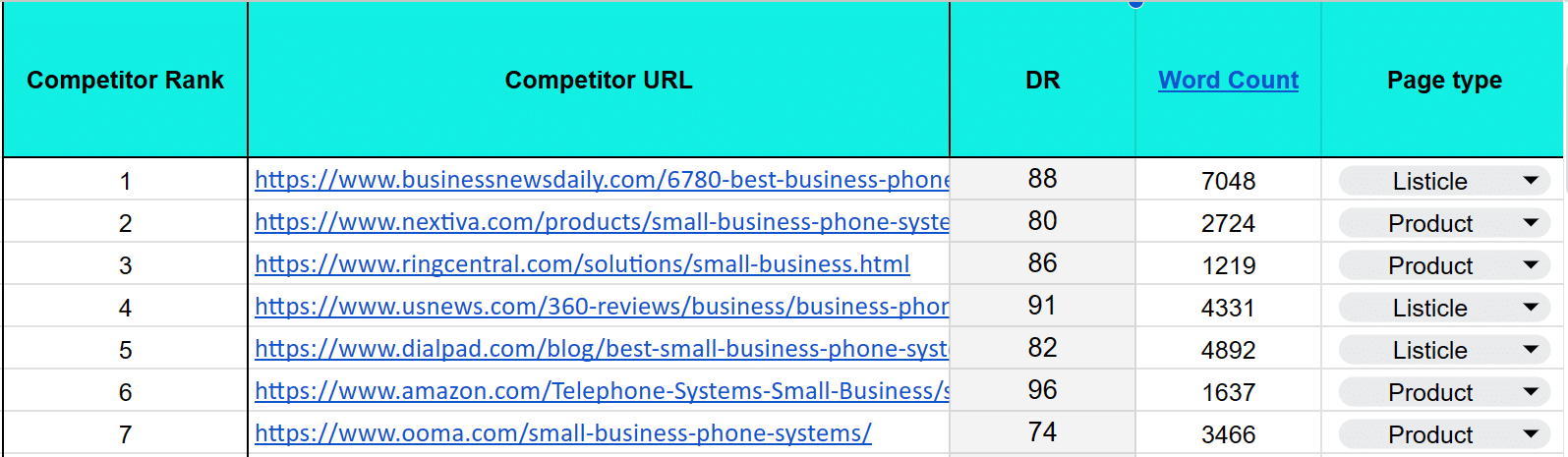

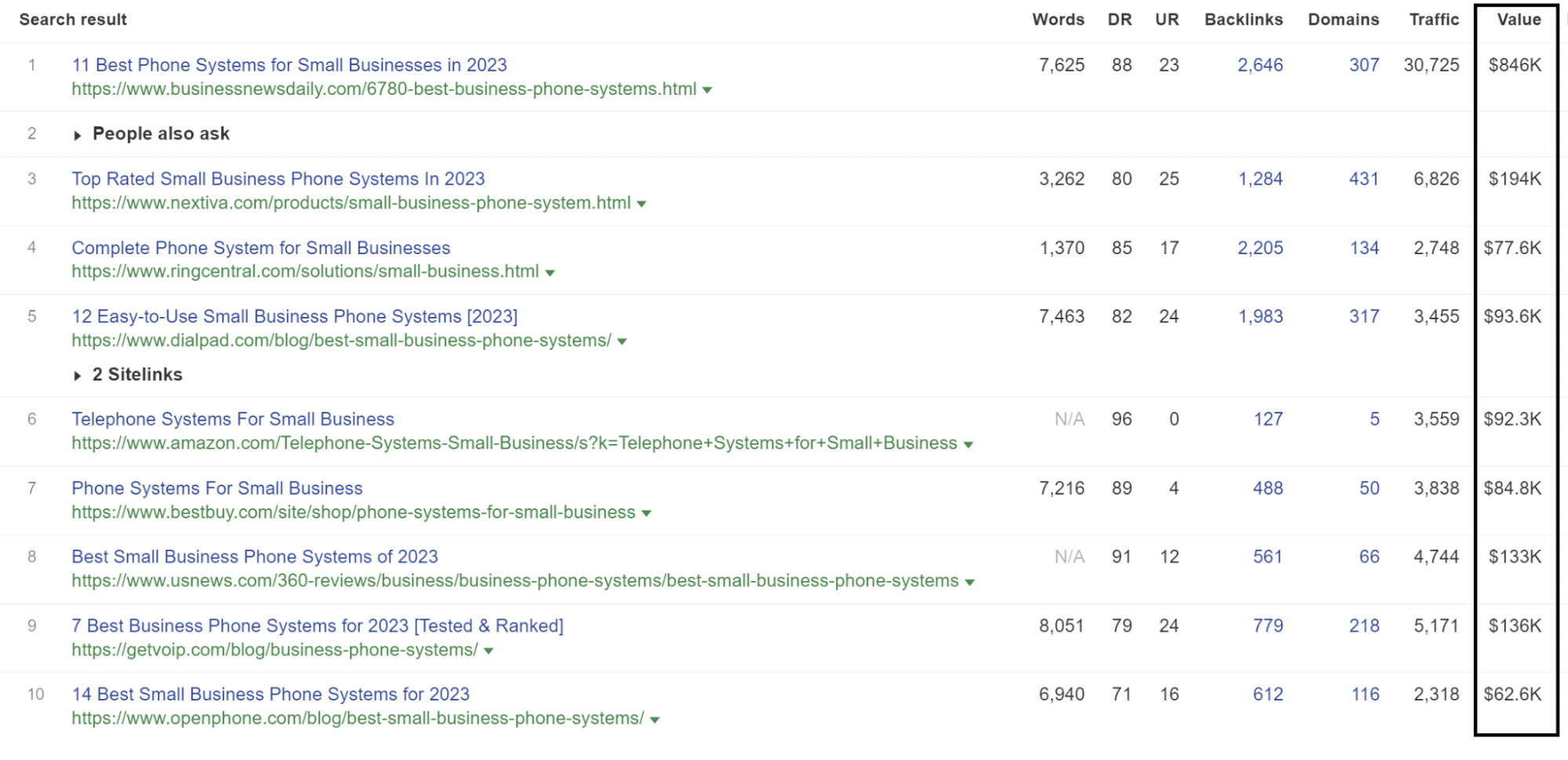

This Single Page Analysis looks at one of the VoIP keywords from the Share of Value graph.

The table shows the top 10 companies currently ranking for “small business phone system”. You can see from the SPA that Nextiva and RingCentral are the VoIP companies leading from an SEO point of view, with Dialpad not far behind.

An SEO analysis of the data shows that this is a very competitive SERP, highlighted by the average DR (Domain Rating) of 85. Competitors are ranking highly with listicles or product pages, so those article types will give the target page the best chance of ranking.

Another important element of the SPA to consider—and one that can lead to quick SEO wins—is how many internal links competitor pages have. For our “small business phone system” SPA, we’ve split this into three sections:

Total internal links consists of all links on the page, including menu, header and footer or other navigation links, and in-content links.

In-content links, meanwhile, are links featured in the page’s actual content, using anchor text. Exact head term in-content links, finally, are those in-content links that use the precise head term in question as that anchor text—in this case “small business phone system”.

As you can see from our analysis, Nextiva’s page has a total of 901 internal links but only 64 of those are in-content links. That tells us that they likely have a footer or menu link on their page. The proportion of non-content to in-content links is also similar for RingCentral and Ooma.

From experience, we know that good in-content links with relevant anchor text are given much more weight than header and footer links, which are often the same for every page across a site anyhow.

Looking specifically at the in-content links of the high ranking Nextiva page is informative here, too. 47 of their total 64 in-content links are using the precise “small business phone system” keyword as their anchor text.

What this reveals is that Nextiva is likely heavily targeting the page for that keyword. The other competitors in this SPA, meanwhile, are probably targeting additional keywords alongside “small business phone system”.

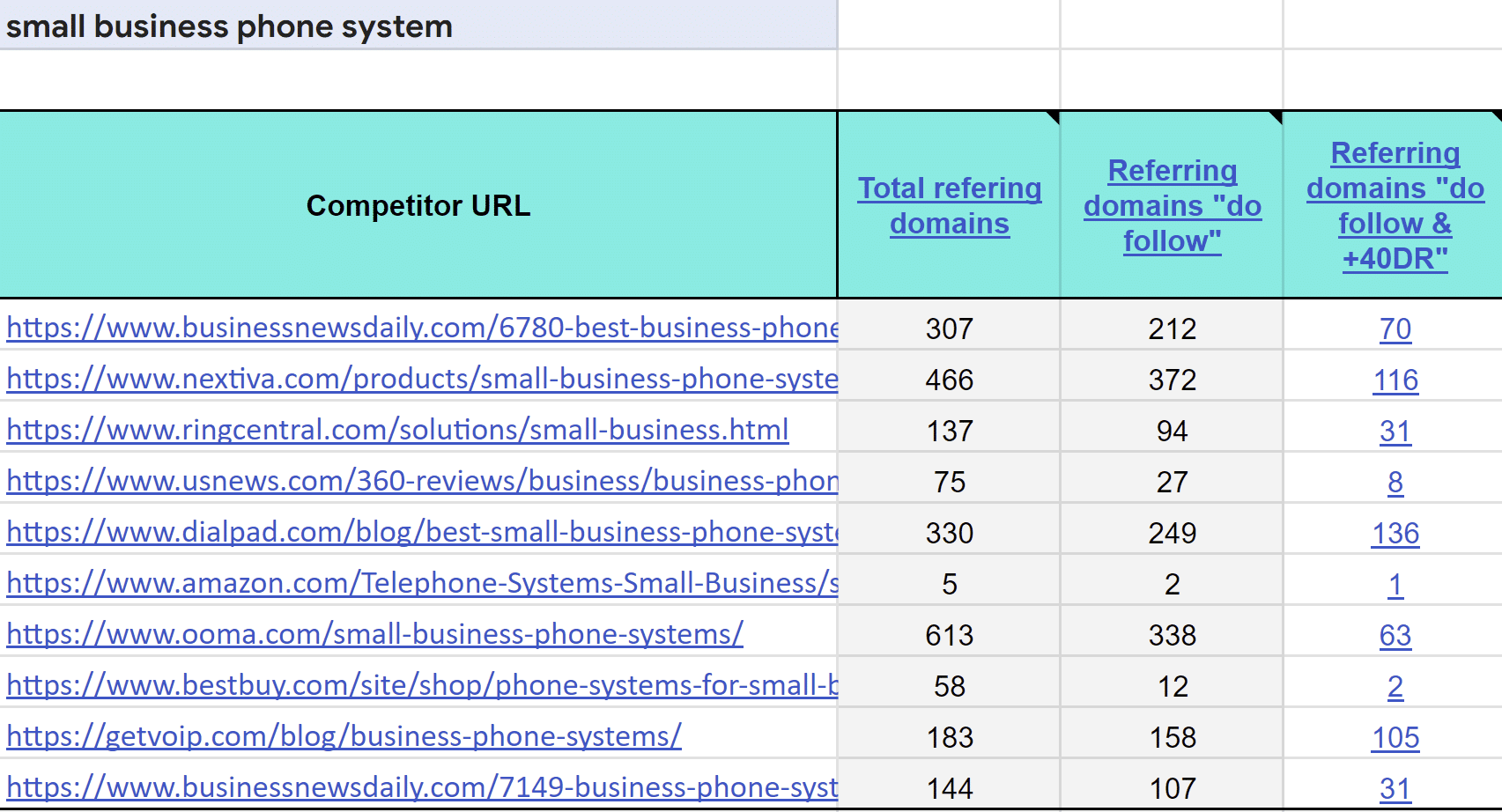

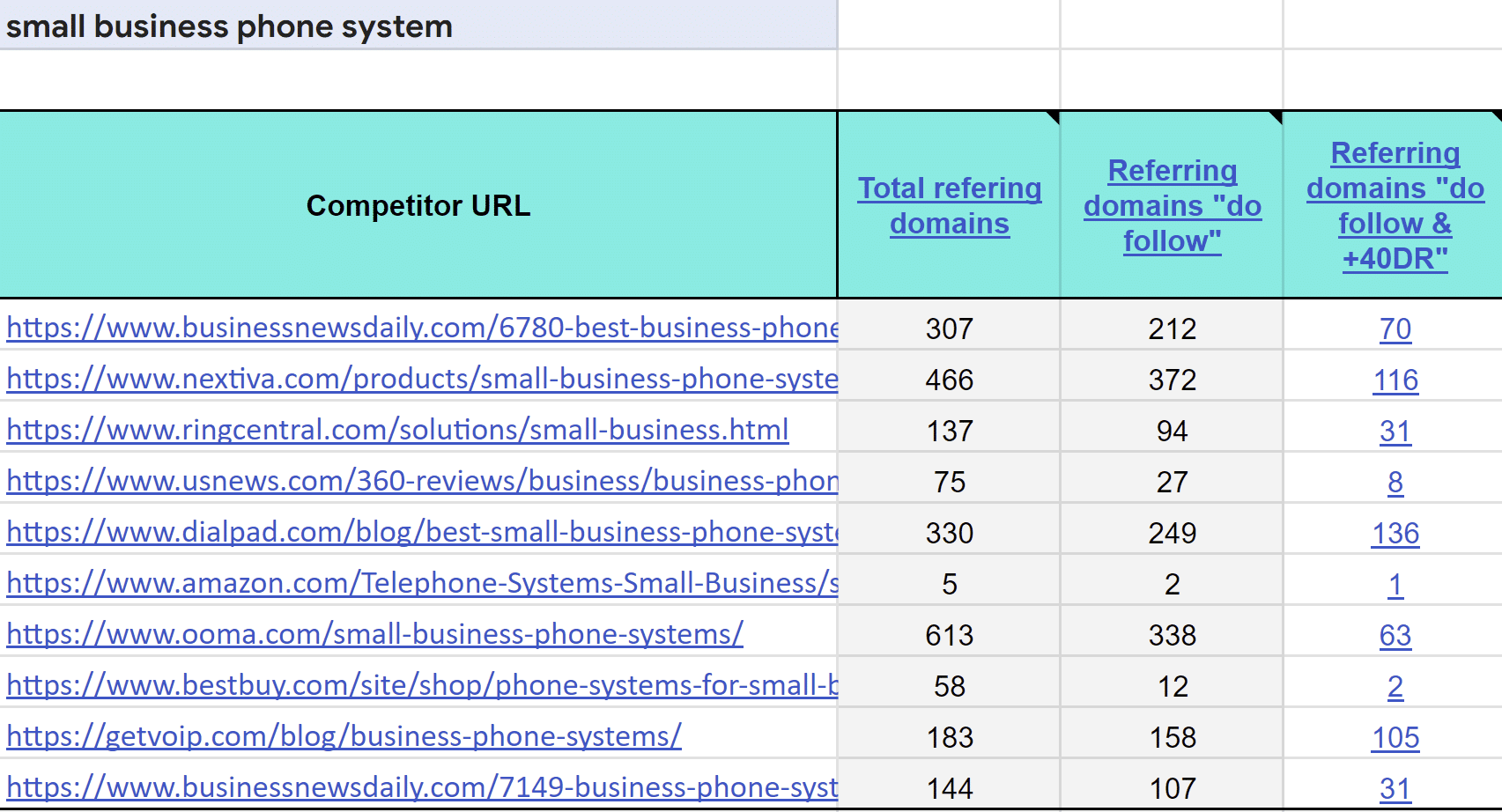

As well as internal links, it’s also crucial to assess how many high quality links to the page from other domains we would need in order for it to rank. The element of our SPA below shows how many referring domains that each URL presently has:

We’ve separated the referring domain links out to show how many are dofollow links and how many of those dofollow links are from domains above 40DR (i.e., higher authority domains).

This gives us a snapshot of how the current top ranking pages are doing, and so reveals how many high authority links we will potentially need to rank a new page in the top three of the SERPs.

Looking at the number of +40DR links that the likes of Dialpad, Nextiva, and GetVoIP have, shows us that the keyword is very competitive. As we saw earlier, too, the most common page types of those pages ranking highly for this keyword are listicles and product pages. This impacts the number of links necessary, too.

In our experience, product pages require around 40-100% more links, but do have higher conversion rates. Listicles, meanwhile, tend to rank well for more than one keyword, which is worth considering when it comes to the overall value derived from a page:

With such competitive keywords, too, the SERPs will change regularly—often daily.

Taking all that in mind, we’d expect it to take in the region of 80-100 high authority links to rank a new page, heavily focused on the “small business phone system” keyword, in the top three.

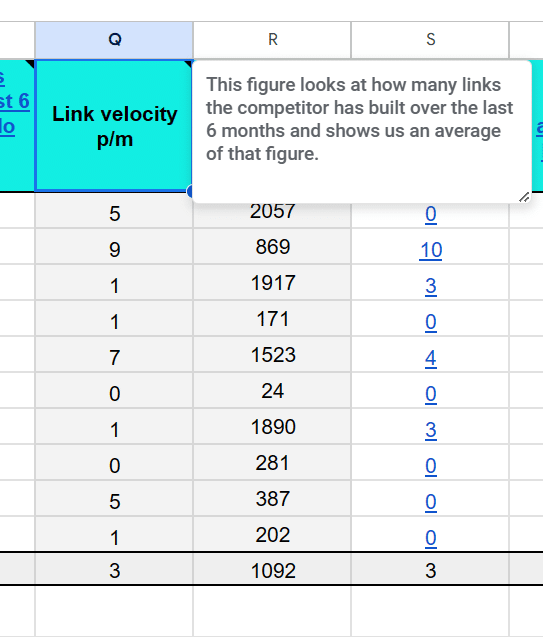

It’s not a static scenario, either, as the competitor pages are also continually building up their own new high authority links. Link velocity is the element of the SPA which provides this insight:

Any new page needs to catch up with the high authority links that existing top ranking results have. Link velocity, therefore, shows you how steep a task that will be, by revealing how much and how quickly those high ranking pages are adding to their own link profile.

Any new page needs to catch up with the high authority links that existing top ranking results have. Link velocity, therefore, shows you how steep a task that will be, by revealing how much and how quickly those high ranking pages are adding to their own link profile.

How much to rank in the top 3 for “small business phone system”?

So, what does all that mean in practical (monetary) terms? How much investment would it take to get a new page ranking in the top three results in the USA?

Assuming around 100 high authority links, we’d estimate a total cost of around $44-52K on content and links (spread out over a period of six to nine months, as too many links too fast would be seen as unnatural and the goal posts may change in the future), plus $1.6-2K per month on additional monthly links and re-optimizations.

To put that into better context, assuming the average CPC is $75, the value for this page, if in position 1-3, should drive in the region of $10,200* of traffic per month.

Communications/VoIP SoV takeaways

Although you may think you know who your top competitors are, a SOV graph uses hard evidence to show you the true picture for your sector.

Because the VoIP sector is so competitive, this insight is crucial for building and refining an SEO strategy that sets you apart from other competitors. Competitors like Dialpad, RingCentral, and Nextiva, which dominate the SERPs in the niche.

Why? Well, at least in part because they keep up the momentum of high-quality content production, regularly maintain and update that content, and achieve high link velocity. As well as giving SEO the attention and time it needs.

So, what you can see from this, is that it takes considerable investment to succeed in SEO for the VoIP niche. Some pages will cost from $5,000 to $50,000, spent on content and backlinks, to rank. Search Engine Marketing (SEM) is also very expensive in this sector.

However, it’s also very lucrative if you do achieve success, with pages able to drive valuable levels of traffic per month.

Our advice before investing heavily in SEO, therefore, is to thoroughly test with SEM, as you may get leads that don’t convert for certain pages. That can be for a number of reasons, including your product not being an ideal fit for a site visitor and visitors who are shopping around and seeking multiple quotes.

Key metrics and why they are important

Our SPA looks at a wide range of key metrics for technical, onsite, and offsite SEO, from word count, to page speed, to branded anchor ratio.

All of these have an impact on rankings. Analysis of the highest-ranking pages shows what they’re doing right, and what you need to do to get ahead.

Let’s define each of the metrics and explain their importance:

SERP rank position

Definition: A page’s ranking based on its appearance on the SERP results.

Importance: The higher a page ranks, the more organic traffic it will receive. Searchers very rarely venture beyond page one, and pages in the top three positions get the lion’s share of clicks.

DR

Definition: Stands for Domain Rating, and is a ranking score up to 100, determining a site’s authority in the eyes of SEO tools like Ahrefs.

Importance: DR demonstrates the relative strength of a website’s backlink profile. It can be useful for assessing the viability of competing for the same keywords as a rival’s site and in judging domains as potential backlink sources.

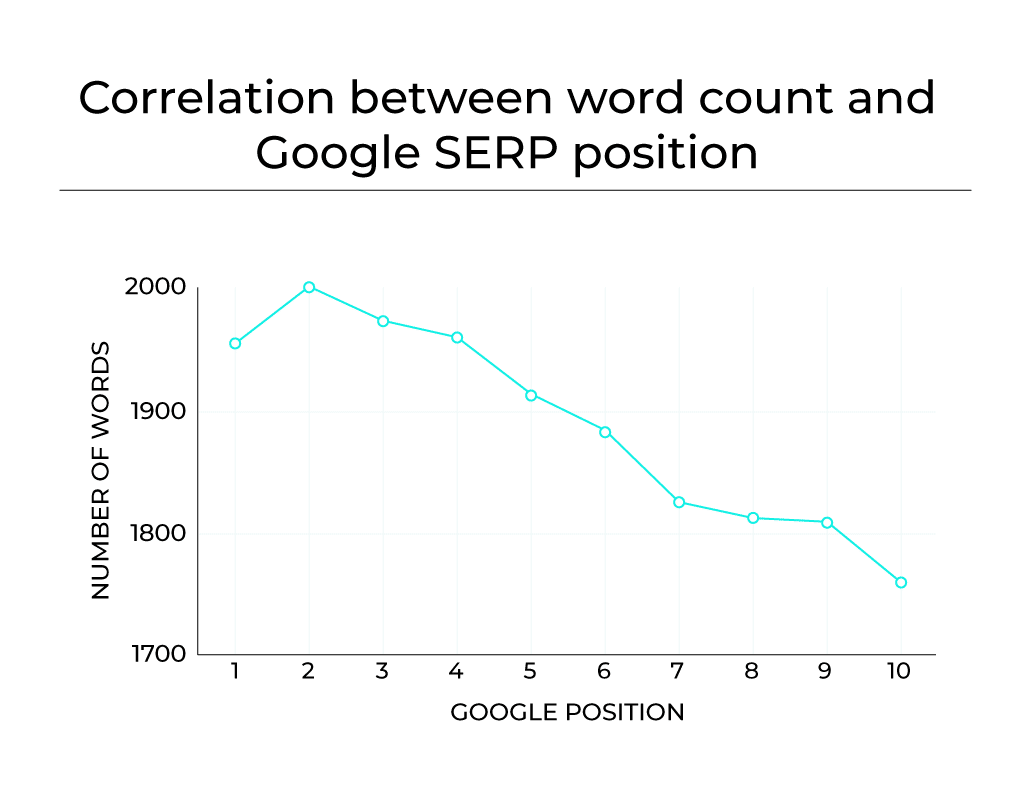

Word count

Definition: The number of words in an article/page.

Importance: Word count isn’t a specific ranking factor, but longer-form content does tend to rank better. The more content, the easier it is for search engines to understand what a page is about. Longer-form content (as long as it’s relevant and useful) also provides a better user experience.

Page type

Definition: Type of page depending on content (e.g., informational, listicle, features).

Importance: Understanding different page types helps you ensure the page is correctly tailored to its audience and their search intent. For instance, a listicle page would suit those looking to compare products but not top-of-funnel searchers wanting general information.

Page speed score (1-100)

Definition: An automated score showing how fast the page’s contents are displayed.

Importance: Page speed is increasingly crucial to SEO. Slow loading pages provide a poor user experience and typically have high bounce rates (searchers won’t wait long). Both those things negatively impact ranking.

Web Vitals status

Definition: Google’s assessment of a page’s overall technical performance, as measured within Google Search Console.

Importance: Web Vitals status is a quantitative measure of the site’s technical performance and, therefore, its user experience.

Total internal (keyword anchor)

Definition: Determined using Ahrefs, this is the total number of dofollow internal backlinks with the target keyword as the anchor.

Importance: This metric helps you assess your general internal linking strategy. When you link to another page on your site, you give that page link authority. Therefore, your best performing pages should have more links to the pages you most want to rank.

Total in content links

Definition: Total number of internal backlinks inserted in content.

Importance: This metric helps you assess your general internal linking strategy. When you link to another page on your site, you give that page link authority. Therefore, your best performing pages should have more links to the pages you most want to rank.

Internal links

Definition: Total number of internal backlinks.

Importance: Internal links aren’t always found within your pages’ content—they also include navigation links, footer links, and more. These also impact UX and how easy your site is to crawl, so it’s important to track and review these links, too.

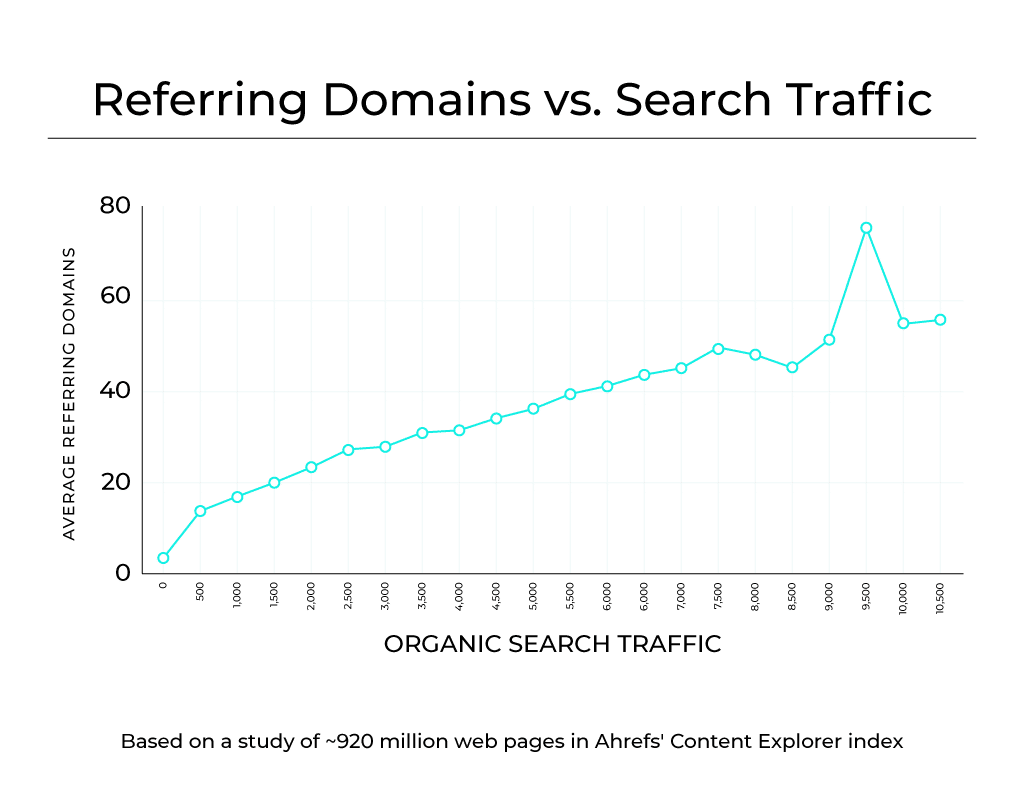

Total referring domains

Definition: Total number of domains that are giving backlinks to a specific page.

Importance: This is a critical SEO metric. The more (high-quality) referring domains that link to your site, the greater the signal sent to a search engine that your content is trustworthy, valuable, and relevant.

Total dofollow referring domains

Definition: Total number of domains giving dofollow backlinks to a specific page.

Importance: Dofollow backlinks pass on authority from the referring website, while nofollow links do not. Therefore, it’s important to understand the ratio between those types of links, which this metric makes possible.

Total dofollow links +40DR

Definition: Total number of domains giving dofollow backlinks with a DR of >40.

Importance: A dofollow link from a site with a higher domain rating (DR) is more valuable than one with a lower DR. That makes it important to track your dofollow links from those higher authority domains, as well as the total number of links.

New links acquired in last 6 months (+40DR)

Definition: Total number of dofollow backlinks acquired within the last six months from domains with +40DR.

Importance: This helps you to track the growth rate of your backlink profile, which can be important when assessing and tweaking outreach strategy.

Link velocity p/m

Definition: Average number of dofollow backlinks that a page is acquiring per month.

Importance: In general, a higher and increasing link velocity suggests that a page is more popular and respected.

Total dofollow backlinks

Definition: Total number of backlinks that are dofollow.

Importance: Very similar to the total dofollow referring domains metric, it’s important to measure the number of dofollow backlinks to understand the authority being passed to your site.

Head term exact match

Definition: Total number of backlinks with the exact head term as anchor.

Importance: Anchor text is a ranking factor, so it’s useful to track the number of backlinks using the exact head term your page is targeting, especially in concert with the “head term exact match ratio” metric (see below).

Head term exact match ratio (%)

Definition: The ratio for how many times the head term has been used as an anchor within the entire backlink profile.

Importance: While exact match anchors are useful, an excessive amount may be viewed negatively by search engines as potentially spammy or manipulated links. It’s useful, therefore, to track the ratio of head term exact match anchors in your backlink profile.

Branded anchors

Definition: Total number of backlinks with the domain’s brand as anchor.

Importance: Branded anchor text is important for building brand recognition online and ensuring a balanced backlink profile.

Branded anchor ratio (%)

Definition: The ratio for how many times the brand is used as an anchor within the entire backlink profile.

Importance: In a similar vein to the above “head term exact match ratio” metric, this one’s importance lies in how it helps you to assess the overall balance of your backlink profile.

How key metrics can be measured/which tools can be used

As you can see, there are a lot of metrics you need to measure. The good news is, there are plenty of tools you can use.

For example, Google Search Console incorporates various SEO tools including PageSpeed Insights, Core Web Vitals, and a Links Report.

One of our favorites is Ahrefs, which provides a host of tools including a domain authority checker and a rank tracker for monitoring your rankings over time and against your competitors. It also measures referring domains and dofollow links.

Other well-known tools include Semrush (which also measures Core Web Vitals, internal linking, and page loading speeds) and Moz, which helps you gather link metrics including page authority and backlink numbers.

To make life easier, we’ve put together a table of tools that can be used to measure the key metrics:

| METRIC | TOOLS |

|---|---|

| SERP rank position | Ahrefs |

| DR | Ahrefs |

| Word Count | https://wordcounter.net/ |

| Page Type | na |

| Page Speed Score (1-100) | https://pagespeed.web.dev/ |

| Web Vitals Status | https://pagespeed.web.dev/ |

| Total Internal (keyword anchor) | Ahrefs |

| Total In Content links | Ahrefs |

| Total Internal Links | Ahrefs |

| Total referring domains | Ahrefs |

| Total do follow referring domains | Ahrefs |

| Total do follow links +40DR | Ahrefs |

| New links acquired in last 6 months (+40DR) | Ahrefs |

| Link velocity p/m | na |

| Total do follow backlinks | Ahrefs |

| Head term exact match | Ahrefs |

| Branded anchors | Ahrefs |

| Head term exact match ratio (%) | na |

| Branded anchor ratio (%) | na |